WB Employees Pension Calculator

Pension Gratuity Calculator is a mobile app that can easily calculate the retirement benefits of an employee. It can accurately tell you what amount you will receive after your retirement.

With just a few clicks, you can calculate the Basic Pension, Family Pension, Commuted Value of Pension, Retiring Gratuity, Leave Salary, etc.

The Pension calculator is based on WB Govt ROPA 2019.

Retiring Gratuity and Death Gratuity Calculation

How to Calculate Retiring Gratuity/ Death Gratuity.

Retiring Gratuity

- The rate of retiring gratuity is one-fourth of the last emoluments for each completed six-monthly period of qualifying service.

- Retiring gratuity is subject to a maximum of 16½ times the last emoluments.

- The maximum amount of retiring gratuity is Rs. 12,00,000/-.

Death Gratuity

- Death gratuity is applicable if the employee dies while in service.

- Rate of Death Gratuity

- Qualifying Service Less than 1 (one) year = 2 times of last drawn monthly emoluments

- One year to less than Five years = 6 times of last drawn monthly emoluments

- Five years to less than 11 years = 12 times of last drawn monthly emoluments

- 11 years to less than 20 years = 20 times of last drawn monthly emoluments

- 20 (twenty) years or more = Half of the last emoluments for each completed six monthly period of qualifying service.

- Death gratuity is subject to a maximum of 33 times the last emoluments.

- Maximum amount of death gratuity is Rs. 12,00,000/-.

Calculation of Basic Pension and Family Pension

- Length of Service

- Qualifying Service

- Six monthly periods of qualifying service

- Last Pay

- Commutation of Pension

Length of Service

Period of service from date of the first appointment to date of superannuation.

Qualifying Service

Length of Service minus Period of suspension minus Period of E.O.L.

Six monthly periods of Qualifying Service

One complete year of qualifying service is equal to two complete six monthly periods of QS. A fraction of a year equal to nine months and above is treated as two six monthly periods of service and a fraction of three months to below nine months is treated as one six monthly periods of qualifying service. A qualifying service period below three months is not counted for six month period of service.

Last Pay

Last pay is the last monthly Basic Pay drawn by the employee.

Commutation of Pension

A Govt employee can commute a maximum of 40% of their Basic Pension.

How to calculate a Pension

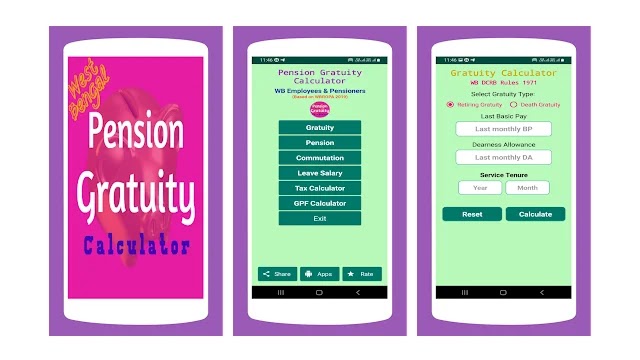

Pension Gratuity Calculator for WB Govt Employees

The Pension Gratuity Calculator android app is based on West Bengal DCRB Rules 1971.

YOU MAY ALSO LIKE

WB Employees Salary Calculator

Screenshot Pension Gratuity Calculator

Features of WB Pension Calculator

This utility app is very much helpful to:

- WB State Govt Employees

- Teaching and non Teaching staff of Schools

- Employees of WB Board of Primary Education

- Employees of District Primary School Councils

- Non-teaching employees of all State-aided Universities

- Employees of West Bengal Board of Secondary Education

- Employees of West Bengal Council of Higher Secondary Education

- Employees of West Bengal Board of Madrasah Education

- Employees of West Bengal Council of Rabindra Open Schooling

Main Features

- Easy to understand calculations

- Easy User interface

- Simple and clear design

- Fast and accurate application on all devices

- Calculate all the pensionary benefits in one app

- Calculate Gratuity, pension, commutation, Leave encashment

- Also calculate death gratuity, family pension, etc.

- New pension scheme West Bengal govt employees 2019

I found this calculator very useful for calculating pension gratuity for government employees in West Bengal. Thank you for sharing!