In this post, you will find a complete guide on filing Income Tax Return (ITR) online. This post intends to clear the doubts about the income tax return. Read the article to educate yourself and be accurate while filling an income tax return online.

Are you familiar with the word ITR? Don’t worry if you are not. Here, you can find the details of ITR and how to file ITR successfully.

Step-by-step Guide on filing ITR

ITR stands for Income Tax Return. This article is an easy-to-follow guide on how to file Income Tax Return online.

File Income Tax Return online for salaried employees 2021-22

Before going further, we will know whether filing a return is necessary. You must be eager to know in which case filing Income Tax Return is mandatory.

Is it mandatory to file ITR?

Income Tax Return filing is not compulsory only when your gross income is less than the maximum exemption limit. The maximum exemption limit or the basic exemption limit for Assessment year 2021-2022 is ₹250000. But, it is mandatory to file a return when gross income exceeds rupees 250000 before any deductions.

Moreover, if your taxable income is more than ₹500000, you must file your tax return. Else, you can be penalized by the Income Tax Department.

Basic Exemption Limit for Assessment Year 2021-22

The basic exemption limit is the maximum amount of income not having any tax liability as per the Income Tax Act 1961. Hence, individuals having taxable income less than the said limit will not be liable to pay any tax.

The basic exemption limit for Assessment Year 2021-22 is ₹250,000 for an individual below 60 years.

However, the exemption limit varies in different age groups. For the age group of 60 years to below 80 years, the limit is ₹300,000. The exemption limit is ₹500,000 for individuals above 80 years.

An individual having gross income less than the basic exemption limit doesn’t need to file an income tax return. But, income tax return filing is compulsory before the due date if your income exceeds such exemption level.

Filing a return is mandatory for

- Gross income exceeds the basic exemption limit.

- To claim of refund for excess deduction of TDS from savings.

- To carry forward your losses.

- Income level comes under any tax liability or/ and any deduction of tax has been made.

- For an income from property under a trust.

- Filing an income tax return is compulsory for every firm or company.

- An NRI should file an income tax return for his taxable income from India.

- Indian residents having any property outside India should file the return.

- You have to furnish your return acknowledgment to the institution to process your loan or visa application.

Start filing of Income Tax Return online

Visit Income Tax Portal or click here to visit https://www.incometax.gov.in/iec/foportal/

Click Login to proceed

Next, enter PAN in user id box and continue. Now enter the password in new page and continue to next page.

Here, click on the File Now Button. Thereafter choose Assessment Year and press Continue button.

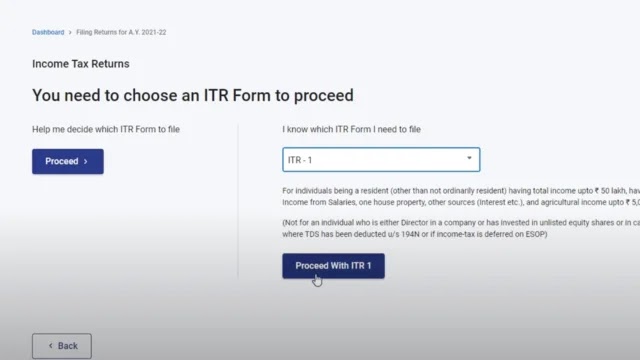

Further you need to choose online option for mode of filing and proceed. Now you have to select ITR Form from drop-down menu to file your income tax return.

How to File ITR 1 for salaried employees

Choose ITR 1 from drop-down and proceed with ITR 1 as shown in the picture below.

You need to declare the reason for filing income tax return to proceed further. If your income is more than basic exemption limit, you can choose that reason to proceed.

Now fill the details and confirm the sections one by one like personal details, Income details, Deduction details, etc.

Verify your income tax return online

To complete your verification of Income Tax Return, you have to choose a verification method. System will provide you three options.

1. e-Verify Now

2. e- Verify Later

If you need some time to e-verify your return, you can use this option to submit the return and verify the same in next 120 days.

3. Verify with ITR-V

How to e-Verify the ITR

Once the validation of your ITR becomes successful, you can proceed further to verification the return. There are several ways to verify your return online. You can verify your income tax return by using

- Aadhar OTP

- Digital Signature Certificate (DSC)

- Electronic Verification Code (EVC)

Again you can generate EVC in several manners.

- Through Net Banking

- Through Demat Account Number

- Through Bank ATM

If you have already generated EVC or received Aadhaar OTP, you can choose these options too for the verification of ITR.

Once the verification gets successful, you can submit the ITR and download ITR-V to keep for record.

Next: Professional Tax in West Bengal 2021-22